To properly manage your finances, achieve financial stability, and work toward your long-term goals, you must create and follow a monthly budget. This post will walk you through the steps of making a monthly budget and offer advice on how to follow it.

Knowing How Important a Monthly Budget Is

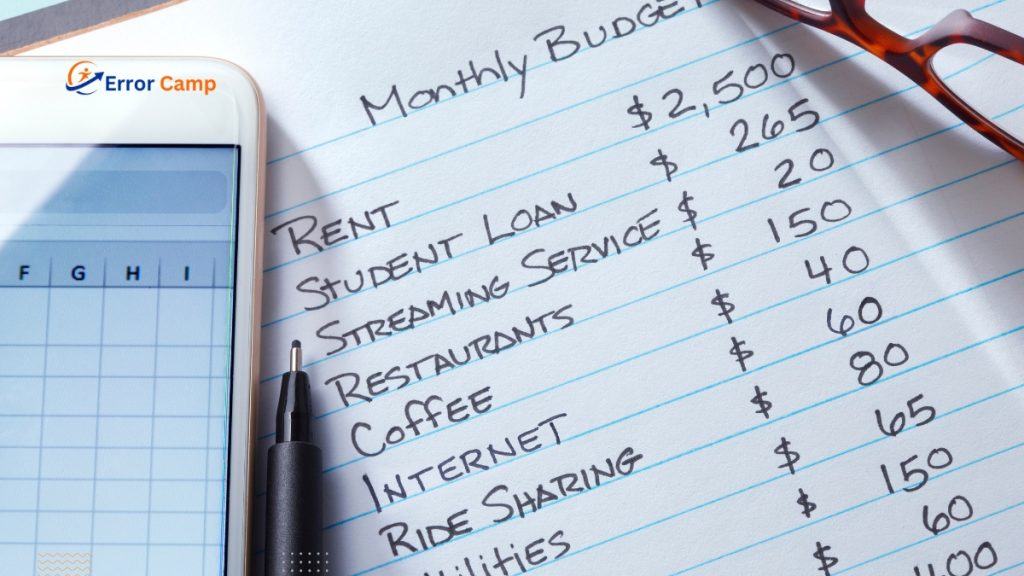

More than just a financial plan, a monthly budget is a tool that assists you in prioritizing your spending, understanding where your money is going, and making thoughtful financial decisions. With a well-defined budget, you can:

Monitor Your Spending: Determine where you can save money and make cuts.

Establish financial objectives: Whether you’re saving for a trip, paying off debt, or creating an emergency fund, a budget enables you to allocate funds.

Decrease Financial Stress: Financial concern can be considerably decreased by being aware of your specific assets and where they are going.

First step: Determine How Much Money You Make Each Month

Your income is the basis of any budget. Here’s how to compute it precisely:

Determine All Revenue Sources

Include your salary, wages, bonuses, side gigs, and passive income, among other reliable sources of revenue. Keep thorough records of your contracts and payments if you are a freelancer or have erratic revenue so you can calculate your average monthly income.

Step 1: Make use of net income.

After taxes and other deductions, figure out your net income, or take-home pay. This is how much you really have to work with when creating a budget.

Step 2: Keep Tabs on Your Spending

The creation of a realistic budget requires an understanding of where your money is going.

Techniques for Monitoring Spending

You can monitor your expenditures in a number of ways:

Manual Tracking: Keep a tiny notepad with all of your purchases, or gather receipts and report them later.

Apps for budgeting: Use apps that connect to your bank account to automatically monitor your expenditures.

Bank and credit card statements should be reviewed at the end of each month.

Sort Out Your Spending

Divide your spending into two primary categories:

Rent, a mortgage, utilities, auto payments, and insurance premiums are examples of fixed expenses.

Gas, food, entertainment, and eating out are examples of variable costs.

See Also: The 30-Day Rule: What is It? A Complete Guide to Budgeting

Step 3: Create a Budget

Now that you know your income and expenses, it’s time to create your budget.

Put Your Expenses First

Determine the necessities (needs) and the wants (wants). Put your necessities ahead of your wants. Typical necessary costs consist of:

Mortgage or rent, utilities

Insurance premiums for food

repayment of debt.

Distribute Funds

Depending on your priorities and money, allocate a certain amount to each category of expenses. Don’t forget to budget for debt repayment and savings contributions.

A guideline for the Rule of 50-30-20:

50% goes for necessities, such as groceries, utilities, and rent.

30% goes on wants, which include luxuries like hobbies and entertainment.

20% goes for investments, debt payments, and savings.

Step 4: Monitor and Adjust Your Spending Plan

A budget requires constant observation and modification; it is not a static document.

Keep a Close Eye on Your Budget

Keep tabs on your expenditures to see how they compare to your projected budget. Spreadsheets or budgeting software might help in this procedure. Make the necessary adjustments to your budget if you discover disparities.

Adapt to Changes in Your Life

Budgets must be adaptable to changes in your life, including increases in income, additional debts, and family size. Review your budget on a regular basis to make sure it still fits your objectives and financial status.

Advice for Maintaining Your Budget

Here are some more pointers to help you stay inside your spending limit:

Make Use of the Correct Equipment

To keep track of your expenses and maintain organization, use spreadsheets, online templates, or budgeting applications. You Need a Budget (YNAB), Mint, and Personal Capital are a few examples of useful tools.

Practice spending as little as possible.

Assign each dollar to investments, savings, or expenses to be sure it serves a purpose. This approach guarantees that you are not overspending and helps you understand where your money is going.

Add a Category for Contingencies

A tiny percentage of your budget should be set aside for unforeseen costs. By doing this, you can prevent depleting your savings or incurring debt when unforeseen expenses occur.

Spend after saving.

Make saving your first priority by allocating your savings before making any other purchases. This guarantees that you are steadily advancing toward your financial objectives.

Remember to Include Fun in Your Plans

Making a budget involves more than just saving money; it also involves having fun. To maintain a realistic and sustainable budget, don’t forget to add a line item for hobbies and amusement.

Common Budgeting Errors to Steer Clear of

By being aware of frequent mistakes, you may better avoid them and maintain your spending plan.

Lack of Spending Tracking

Overspending and budget inconsistencies may result from not keeping track of your expenditures. Keep an eye on your spending to keep under your budget.

Unreasonable Budgeting

Unrealistic budgeting can cause dissatisfaction and budget abandonment. Make sure your budget is founded on actual spending patterns and financial objectives.

Ignoring Emergency Funds

You risk blowing your budget if you don’t account for emergency costs. Always have money set aside for unforeseen expenses.

Conclusion:

An effective strategy for managing your money, achieving financial stability, and advancing your long-term objectives is to create and follow a monthly budget. These procedures and pointers can help you make sure your budget is practical, efficient, and long-lasting.

Concluding Advice

Have a flexible attitude: Your budget should adapt to your changing needs.

Prioritize Savings: Savings should be viewed as an unavoidable expense.

Utilize tools for budgeting: Make budgeting simpler by using spreadsheets and apps.

Review Often: Make sure your budget stays in line with your financial objectives by reviewing and adjusting it on a regular basis.